Empowering Renters:

Achieve Home Ownership & Build Generational Wealth

Transforming Renters into Homeowners with Innovative, Community-Driven Solutions.

Our Vision

To be the go to company for building generational wealth in New York and New Jersey within the next 5 years.

Our Mission

We help individuals and families achieve the American dream of homeownership through affordable housing, financial guidance and joint venture solutions

Our Core Values

-

Empowerment: Enabling individuals and families, especially immigrants, to achieve home ownership and build generational wealth by providing the tools, resources, and support needed to overcome financial barriers.

Empowerment: Enabling individuals and families, especially immigrants, to achieve home ownership and build generational wealth by providing the tools, resources, and support needed to overcome financial barriers.

-

Community: Fostering a sense of collective responsibility and trust through joint ventures, pooling resources, and leveraging community networks to create sustainable and supportive pathways to homeownership.

Community: Fostering a sense of collective responsibility and trust through joint ventures, pooling resources, and leveraging community networks to create sustainable and supportive pathways to homeownership.

-

Equity: Ensuring that homeownership opportunities are accessible to all, particularly underrepresented groups, by offering affordable housing solutions that promote fairness and inclusivity in the housing market.

Equity: Ensuring that homeownership opportunities are accessible to all, particularly underrepresented groups, by offering affordable housing solutions that promote fairness and inclusivity in the housing market.

-

Innovation: Utilizing creative and culturally relevant financial strategies, such as Esusu, to accelerate the homeownership process and reimagine traditional pathways to owning a home.

Innovation: Utilizing creative and culturally relevant financial strategies, such as Esusu, to accelerate the homeownership process and reimagine traditional pathways to owning a home.

-

Stability: Providing long-term financial stability and security for families by transitioning them from renting to homeownership, thus fostering stable communities and reducing economic vulnerability.

Stability: Providing long-term financial stability and security for families by transitioning them from renting to homeownership, thus fostering stable communities and reducing economic vulnerability.

Our Goals Over the

Next 5 Years

2024

- Secure 100 homes and deploy them to families.

- Establish a strong partnership with lenders, finalize investor pitches, and create a pipeline of end-buyers by leveraging strong partnerships with religious groups.

2025

- Expand the client network seeking home ownership opportunities and begin measuring the project’s impact.

- Secure an additional 100 homes for different families.

2026

- Secure an additional 100 homes for different families.

- Explore alternative funding models to ensure long-term sustainability.

- Help refinance some of the properties already deployed.

2027

- Expand to other geographical areas in New York to reach more immigrants.

- Secure an additional 100 homes for different families.

- Develop educational programs to empower future homeowners.

2028

- Secure an additional 100 homes for different families.

- Conduct a comprehensive evaluation of the project’s long-term social and economic impact on immigrant communities.

Our Goals Over the

Next 5 Years

2024

- Secure 100 homes and deploy them to families.

- Establish a strong partnership with lenders, finalize investor pitches, and create a pipeline of end-buyers by leveraging strong partnerships with religious groups.

2025

- Expand the client network seeking home ownership opportunities and begin measuring the project’s impact.

- Secure an additional 100 homes for different families.

2026

- Secure an additional 100 homes for different families.

- Explore alternative funding models to ensure long-term sustainability.

- Help refinance some of the properties already deployed.

2027

- Expand to other geographical areas in New York to reach more immigrants.

- Secure an additional 100 homes for different families.

- Develop educational programs to empower future homeowners.

2028

- Secure an additional 100 homes for different families.

- Conduct a comprehensive evaluation of the project’s long-term social and economic impact on immigrant communities.

Our Goals Over the

Next 5 Years

2024

- Secure 100 homes and deploy them to families.

- Establish a strong partnership with lenders, finalize investor pitches, and create a pipeline of end-buyers by leveraging strong partnerships with religious groups.

2025

- Expand the client network seeking home ownership opportunities and begin measuring the project’s impact.

- Secure an additional 100 homes for different families.

2026

- Secure an additional 100 homes for different families.

- Explore alternative funding models to ensure long-term sustainability.

- Help refinance some of the properties already deployed.

2027

- Expand to other geographical areas in New York to reach more immigrants.

- Secure an additional 100 homes for different families.

- Develop educational programs to empower future homeowners.

2028

- Secure an additional 100 homes for different families.

- Conduct a comprehensive evaluation of the project’s long-term social and economic impact on immigrant communities.

Our Process

We guide individuals through preselection, credit fixing, and navigating the mortgage qualification process.

-

1. Sign Up

1. Sign Up

Complete our Intake Form and submit necessary personal and financial documents.

-

2. Matching

2. Matching

We will match you with one or two individuals from our pool of applicants, considering compatibility and financial profiles.

-

3. Credit Check

3. Credit Check

We will conduct a Credit Check to assess your eligibility for a mortgage. If your credit score is too low, you may need to pay for credit repair services until it reaches the required level. Once eligible, proceed to pay a commitment fee toward the house downpayment.

-

4. Property Selection

4. Property Selection

Within 3 to 4 months, we will identify and secure a property that aligns with your preferences and financial profile.

-

5. Final Steps

5. Final Steps

Inspect the property and make the balance downpayment towards the mortgage.

Upon completion, you will take ownership and begin making monthly mortgage payments, gradually owning your home.

Take the first step to getting your american dream home.

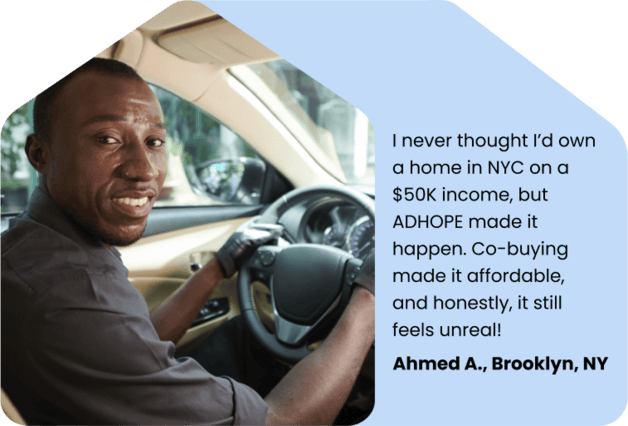

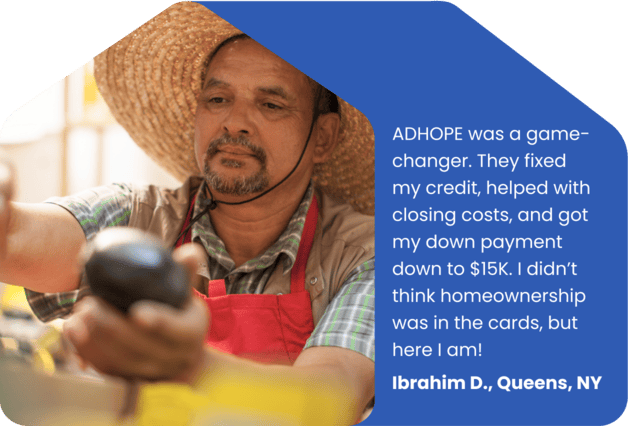

Client Testimonials & Recommendations

See how minority groups like you turned 3,000 rent into 2,000 mortgage payments by teaming up with trusted friends from their Religious and Cultural groups.

Meet the team

Maureen Williams

Founder

- Chase Manhattan Bank

- SunTrust Bank

- Crestar Bank

- 35+ years of experience

- Brooklyn College

Schelton Assoumou

Senior Managing Director

- JP Morgan Investment Banking, Capital Markets; Proprietary Trading Equity

- $25+ Billion in Closed Transactions

- 100+ Million of real estate transactions

- 20+ years’ experience

- MBA Harvard Business School

Martin Assoumou

Chief Operating Officer

- Chevron Oil-Trading Manager

- World Bank-Operating Manager

- Fruit CI CEO

- 40+ years of experience

- Columbia University

Robert Hodges

Board Member

- Founder & CEO, Proficio Consulting

- Co-Founder & CEO, Dent Clinics

- Co-Founder & CEO, Xuma Medical

- COO, Veredus Labs (Acquired by Sekisui Chemical)

- Director, Biomedical BU and Molecular Diagnostics BU, STMicroelectronics

- BS Math, BS Physics, BS EE The University of Texas at Austin

- MS EE The University of Texas at Dallas

Patrick Irene

Head Administration & Finance

- Construction Project Coordinator

- Construction Financial Analyst

- Account Officer

- PMI- Project Manager

- ACCA- ACA (CPA equivalent)

- Ambrose Alli University

- 10+ Years of Experience

Adekola Adelaja

Head Business Development & Sales

- Project Business Analyst

- 15+ yrs Project Management

- 8+ yrs Business Analyst

- 5+ yrs Management Consultant

- FUTA, Nigeria

Asiya Baptiste

Admin

- BNYC – Assistant Construction Mgt

- Travel Admin, Zara Travel Agency

- Sales Clerk, Tektronic

- 4+ years experience

Get in touch

Whether you’re just starting your homeownership journey or ready to take the next step, we’re here to guide you. Send us a message and one of our team members will get in touch to walk you through your options.